Read this article to open the key to fast and secure Magento 2 payment gateways for your store!

Among all options for Magento 2 payment methods, some people can prefer payment with cash on delivery. At the same time, many want to pay using credit or debit cards because of their convenience. Merchants often prefer the cards method, as it is much safer and faster compared to cash transactions. The trend also suggests that payment through credit or debit cards will increase, as, by 2020, 40% of worldwide consumption would be Gen Z.

Some Magento 2 payment gateways simply are a way to charge cards, with fees charged for merchants ordinarily around 1.4% – 3.5%. But, if you have a merchant account, your prices will be reduced to interchange fees, which are often around 0.1% – 20% per payment.

Many Magento payment options gateways in the market can offer both card types, along with other advantages that raise them above the field, from reducing transaction fees to individual cards to integrated into the accounting software.

If business owners want to decide on which payment method they will use, they need to consider their needs and their current transaction fee conditions. Below we’ve listed a selection of payment gateways that we think are the best as Magento 2 payment methods and the service tiers they offer.

Besides payment gateways transaction costs, there are others that a Magento 2 store owner should worry about. It’s not always easy to predict the total expenses before you establish your Magento website. But don’t worry, we can help with that.

MASTER RIGHT AWAY all Magento Costs needed to build Magento Websites.

Payment Gateways Definition and How it works

Table of Contents

Before listing the payment gateways, we should go through a brief overview of payment gateways definition and which criteria should you consider when choosing your business Magento 2 payment gateways?

A payment gateway can be identified as a middleman between a merchant and a bank, and it provides the security validation for credit cards by encrypted cards number. This will protect buyers from identity thefts while the payment is transferred through payment processors.

If you’re new with Magento payment and want to know how to set up Magento 2 payment methods, then:

CHECK OUT How to set up Magento 2 Payment methods (part 1) and (part 2)

How to evaluate a payment gateway?

Choosing the right payment gateway for one business can contribute a large part to the sales that the Magento store will attain. The payment gateway must be qualified with the strategic goals and costs of the businesses, which means it should not cost more transaction fees than planned and should be secure enough. It should also have other features that benefit customers to purchase for more. The requirements used to make a comparison between Magento payment options on gateways are:

Security: This metric measures how secure customers’ data details are protected. Payment fraud must be prevented as well.

Convenience: Despite its complex functionality and security protection over its customers, the payment gateway should still be simple and easy for users to interact with. And the step to register payment should be shortened as much as possible, so the customer can use them quickly when needed.

Capabilities: How many different Magento payment options are offered? Which types of payments are accepted by the payment gateway?

Costs: How much does it cost in payment processing, and are these fees required to pay monthly.

Another additional aspect that you should consider is the compatibilities of the Magento 2 payment gateways with the current Magento platform that you’re using. Magento has two platform editions – open-source and commerce (enterprise). As a business, you should consider the business growth to choose a congruous payment gateway with both versions, as the majority of payment gateways don’t reach Magento Enterprise Edition.

Contrastive analysis of Payment Gateways, Payment Processor and Merchant Account

It’s easy to mistake a payment gateway and a payment processor. Therefore we will clarify the differences between a payment gateway and a payment processor and how those two are related to a merchant account.

Payment Gateway

As we stated before, the Magento 2 payment gateways are the middleman between a merchant and a bank. Still, the payment gateway doesn’t make the transaction. It just validates and secures the financial information and makes sure that information is transferred from the customer to the merchant and the merchant to the bank.

Payment Processor

Magento payment processors are links between your customer’s bank and yours. The Magento payment processors are the institution that does the transaction works behind the scene. It processes the query from the payment gateway, then validates and executes them, transferring the money from the customer to the merchant account. Once the action has been done, it will inform back to the customer gateway that the transaction is successful or not.

Here is the Magento payment gateway & Magento payment processors operation in a nutshell:

Merchant Account

The merchant account is a bank account on the merchant’s behalf, and it will be where the credit or debit card funds deposit arrives after the transaction. The merchant account will enable Magento payment options to accept the credit & debit cards if they are transferred from a payment processor.

Here is the difference: Payment Gateway is in charge of accepting or approving financial transactions, while a Merchant Account receives payment transactions from credit & debit cards.

Having a merchant account is optional, so you don’t have to have one as a retailer.

Top 10 Magento 2 Payment Gateways in 2020

Here are the top 10 Magento payment options on payment gateways in 2020 that we would recommend for Magento store owners:

Paypal

PayPal is, without a doubt, the most significant player in the field. It is well known for both store owners and buyers with over 218 million consumer accounts and was used by 17 million merchants. One of the plus sides of using PayPal is many people already have a PayPal account, which makes the payment process easier.

PayPal also offers many features like it accepts credit cards, including Amex and Visa; PayPal Pro also allows 26 currencies in 200 countries. It provides easy card integration, customization options, online voicing, etc.

The pricing is also competitive, with process charged at 2.9% per transaction, with no monthly fee, which is why it is an appealing solution to small and medium enterprises.

READ NOW for Magento 2 Paypal setting for faster checkout!

Stripe

Among the Magento payment options, the Stripe payment gateway is also one of the top delivers. Available in 25 countries, Stripe offers you a few features, including billing customers on a recurring basis, setting up a marketplace, or just simply accepting the payment, all within one platform. Stripe payment gateway supported up to 100 currencies and have integration with Android and iOS system for in-app payments. When you’re tech-savvy, you can create cool things with Stripe.

However, there are some limitations to using the Stripe payment gateway. The gateway doesn’t support a 3D secure service, and you will be charged extra if you try to change the functionality of Stripe.

Authorize.net

Authorize.net advantage over other Magento payment options is the simplicity that it brings. It is much easier to set up compared to PayPal or Stripe. The payment gateways are designed for merchants to sell in both local and online stores. It covers the work of a full staff, organized and store data, which will help you find frauds without constant check. Authorize.net is regarded as one of the best Magento 2 payment methods around.

Authorize.net fees for merchant accounts include a monthly gateway fee of $25, with a per-transaction fee of $0.10, and daily batch fees of another additional $0.10. The pricing of Authorize.net is tailored for large enterprises’ needs.

WePay

Wepay is one of the Magento payment options that target omnichannel, point of sales (POS), and the web-based requirements of the software platforms.

Some of the highlight features of Wepay include instant registering, in which the merchant just needs an email address for a signup and will be ready for accepting payment. It also has API-based Magento 2 payment methods, and for both online and in-person interactions, it allows a customizable process where you can have full control of the way the flow will go.

The payment gateway does include extensive support for multiple payment schemes that include ACH, debit, and credit payment, and your customer has a choice of paying on a monthly, weekly, or daily basis.

WePay charges you 2.9% + $0.30/ transaction, and there are no other costs needed. For ACH payments, they process them at a reduced cost of 1%+ $0.30.

Skrill

Skrill is the newly successful UK-based Magento payment options that created with both business and individual in mind. Within Europe, customers can ask for a prepaid Mastercard, and use the card to withdraw funds or purchase goods wherever they feel convenient. Skrill supports over 30 currencies, and you can target buyers for your products & services worldwide.

The fee to create a Skrill account is free, and Skrill charges as low as 1 – 2% for different types of transactions. For more information regarding fees of this payment gateway, visit Skrill Fees & Charges.

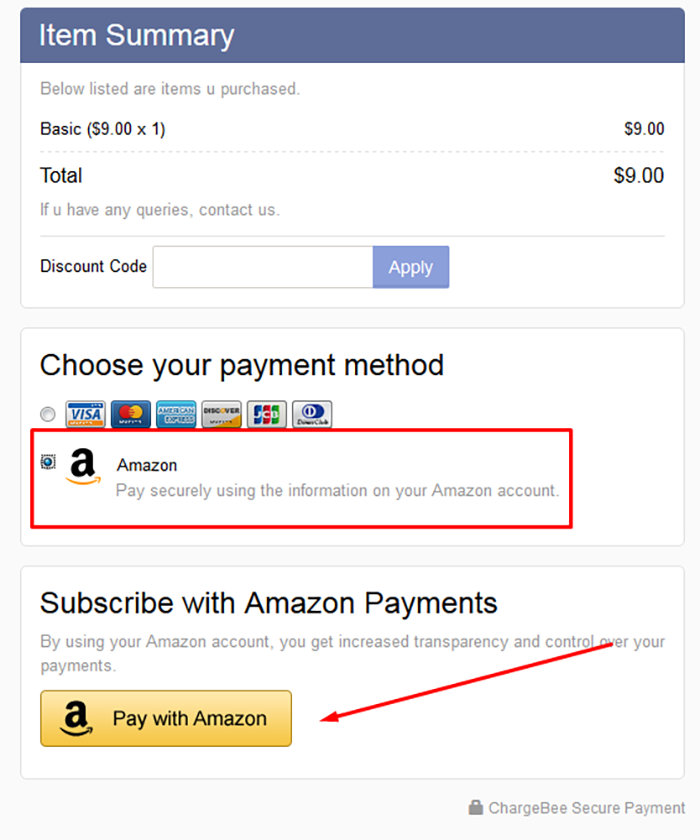

Amazon Payment

Amazon Payment started its service back in 2007, offers a secured and streamlined services for its customers. Clients of Amazon Payment now can perform all transactions on-site with just one account. It helps people have a smooth shopping experience because they no longer need to enter their personal and business information for different sites.

There is no monthly and license subscription to worry about with Amazon payment because Amazon fees are transaction-based and have a processing and authorization component. The transaction fees for Amazon Payment would be composed of a domestic fee of around 2.9% and an authorization fee of $0.30, including tax when the payment was authorized and processed.

Braintree

Braintree is an all-in-one Paypal service suitable for firms at all business sizes and types. It allows business owners to accept, send, process, and split the payment in a way that suitable for them and maximizing their revenue. Because they are partnered with a well-known payment provider PayPal, they are confident in a seamless checkout process and give users in 40 countries market the support of over 130 currencies.

To suit the needs of all business, Braintree offers their service in four modules aimed to merchants and donation collectors, businesses who are looking to process their payment for better management, providers who are looking to collaborate with merchants and act on their behalf, and businesses who are looking for partnership and revenue opportunities.

Sage Pay

SagePay plays on its strength, which is the priority in security and fraud reduction. The platform offers two tiers of the package: the business package that is for small and medium businesses, and the corporate package for larger enterprises. Both packages will enable you to accept the majority of credit and debit cards, including Visa, Mastercard, and PayPal.

Some interesting features that SagePay enable users are: customizing your pages and access transaction through your mobile phones and also include the reporting tool that will help you monitor your transactions.

SagePay monthly fees from £20.90 for 350 transactions, or £45 for 500 transactions per month. For corporate packages, they have bespoke pricing. There are no costs for setup; however, if you’re registered PCI DSS certificate, they will charge you £20.

Cybersource

Cybersource is one of the leading providers in Magento 2 payment methods and offers payment gateways in over 50 currencies, and in 28 languages. Cybersource only available to use for Magento Enterprise edition, but it also acquired Authorize.net; therefore, it will have access to the giant pool of customers up to 400,000 businesses worldwide.

Cybersource was trusted in payment processing, fraud detection, and data protection. It allows many credit and debit cards and multiple alternative digital payments: Visa and Mastercard, Paypal or Visa Checkout, and more.

For fraud management, Cybersource offers features such as Address Verification Service, Card Verification Number, Fingerprints and Case Management, etc.

Cybersource charges a fee of $0.35 per transaction, Visa and Mastercard are subjected to a 2.39% discount.

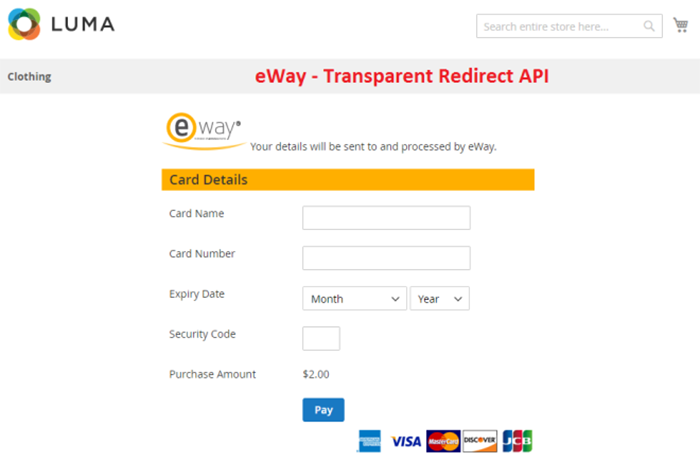

eWAY

Another gateway that also available for the Magento Commerce edition is eWAY. eWAY is an Australian-based payment gateway provider and accounts for 25% of Australia’s online market and trading in 5 countries. eWAY has the advantage of easy setup and more than 250 integrations that require little to no coding skills. Another plus point of the gateway is free fraud prevention tools, which will enhance the protection for your business’s customers.

You can also enjoy the low flat-rate transaction fee eWAY offers at 1.5% + 25c for’ both domestic and international cards.

Which payment gateways work best with drop-shipping?

It is a tough question to answer because when it comes to Magento 2 dropshipping, there are a few things that you need to check:

- First, you should see if the payment gateway is popular in the country that your targeted customers will be.

- You should make sure that the payment gateway offers a low transaction fee.

- Is it compatible with a dropshipping store? Many ecommerce payment gateways don’t prefer drop shippers as the refund rate is higher.

- Check if you can use the gateway if you decide to go international.

- See if the gateway offers a pleasant shopping experience for its customers.

Based on the conditions we have listed above and the information we have already provided about the Magento 2 payment gateways, here are the top choices of Magento 2 dropshipping payment gateways:

- PayPal

- Skrill

- Authorize.net

- Stripe

- WePay

Aside from choosing your payment gateway from the recommended picks, you can select two gateways to try it out if you are dropshipping for the first time. For a combo Magento 2 dropshipping gateways, we recommend:

- PayPal and Skrill

- Stripe and PayPal

If you are the fresh dabbler in Magento 2 dropshipping, then:

GET STARTED NOW with five steps to start Magento 2 Dropshipping Business.

Conclusion

When configuring Magento 2 Payment Methods, you will encounter how to choose payment gateways for your Magento business website. We hope that this post can be the handbook that gives you useful guides in choosing suitable gateways for you. Do not hesitate to ask us for more information about the topic in the comment section below. We’ll be happy to answer your inquiries.

BSS Commerce is one of the leading Magento extension providers and web development services globally. With experienced and certified Magento developers, we commit to bringing high-quality products and services to optimize your business effectively. Furthermore, we offer FREE Installation – FREE 1-year Support and FREE Lifetime Update for every Magento extension.

CONTACT NOW to let us know your problems. We are willing to support you every time.