In the B2B business model, payment plays a critical role as it directly affects business performance and image. Let’s imagine how bad it could be if your B2B payment methods and payment processing are not reliable and secured enough.

But you don’t have to worry about collecting payments from online orders as there are a lot of B2B payment methods available for you to choose from. Therefore, nowadays, processing B2B payment is not a difficult task anymore.

Overview of B2B Payments

Table of Contents

The Development

It’s relatively easy to define what B2B payments are. B2B payments include all transactions, payments made between one business and another for products (goods or services). Compared to B2C, the B2B payments process is more complicated, which we will explain in the next section.

Along with the B2B business model’s growth, B2B payments have seen a significant trend. According to GlobeNewswire, it was recorded that the global B2B payments market mounted up to $732.4 billion in 2019 and is projected to be $1900.6 billion by 2029. And it is expected to register a CAGR of 10.1%. The researched market was based on transaction type, business segment, operating channel, and region.

B2B Payment Vs. B2C Payment

People might think that all payments are the same. However, they are different depending on different business models. Understanding these differences will help you choose the most suitable B2B payment methods.

Here are some differences between B2B and B2C payments:

- Volume: It is the most apparent difference between B2B and B2C payments. When it comes to selling business to business, customers usually place orders in bulk, which means that the amount of money paid is also much higher than B2C payments.

- Contract: In the contract between businesses, B2B payment terms are clearly clarified. For example, payment shall be made through which method, the deadline for the payment process, etc. But in B2C, these terms might not exist.

- Payment postponement: B2B payments are usually made in large amounts, which means that they cannot be made in a few seconds as personal payments. In this case, it often takes about 30 – 90 days to complete payment.

- Payment method: Payment methods in B2C are more variable. Customers can freely choose any form that is convenient for them. However, B2B payment methods are more limited as they are patently stated in the sales contract. Moreover, payment methods for B2B need to be chosen more carefully.

6 Most Common B2B Payment Methods

Paper Check

Source: OROCommerce

Among B2B payment methods, paper checks are the most commonly used, despite their antiquation. In 2019, 51% of B2B businesses still used paper checks for their transactions. The paper check method has several benefits: reliability, ease of keeping track of, no bank account required, etc.

However, it might be risky when using checks due to poor handwriting and the lack of an electronic paper trail. Such cases might be weird, but it did happen sometimes. Besides, using this B2B payment method might be complicated as such a physical paper needs to be transferred in person or by mail, which will raise a time-consuming issue.

Credit Card

Credit card payment is now becoming a standard B2B payment method for wholesale businesses to collect money. B2B card payment is a convenient method. Moreover, it is easy to keep track of transactions in a period with an electronic or paper statement.

However, there are several drawbacks to B2B credit card payment.

First of all, the percentage fee charged is quite expensive, especially if you place a high-volume order. Secondly, some accounts have a maximum transaction limit, making it impossible to make a larger payment.

ACH (Automated Clearing House) Payment

ACH (Automated Clearing House) is another B2B online payment method faster and more effective than physical-paper methods. It is similar to paper checks but in digital form. Through a routing number and bank account, the paper moves electronically from this entity to another.

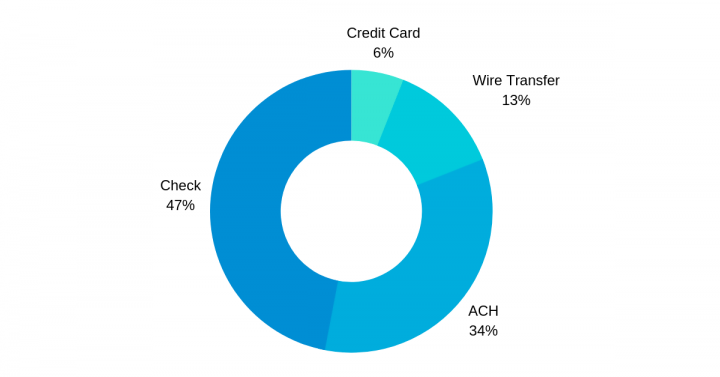

ACH payments are quite suitable for B2B recurring payments. In 2018, 34% of B2B payments were processed through ACH, and 83% of B2B businesses used this method. This popularity resulted from several reasons.

ACH is beneficial because of its cost-effectiveness. In reality, some financial institutions want to boost ACH over paper checks that they charge nothing for this B2B payment method. ACH is also advantageous in managing cash flows and settling accounts as you can keep track of transactions through statements. Notably, it can be integrated into an ERP system or other applications.

However, B2B ACH payments are only available in the US at a specific time daily. Therefore, if you miss this period, you have to wait until the next day to process payments.

Bank/Wire Transfer

If you want to make international payments, B2B wire transfer is a suitable method. Wire transfer is a B2B online payment method between financial institutions. It is like transferring cash in person but much more secure. There are 2 types of wire transfer:

- Cash base: Money is sent to the cash office.

- Digital base: Money is sent electronically from one bank to another.

Different from ACH, the batch system is not applied to wire transfer. Wire transfers are processed individually, which results in a faster turnaround time. Therefore, wire transfer is a quick and reliable payment method.

In terms of drawbacks, like ACH, some wire transfers are only available at a specific time within a day.

Cash

In B2B business, cash is the least common payment method. With the development of technology and the insecurity of having a lot of cash in hand, and the difficulties in keeping track in transit, cash is now an inefficient method.

But in fact, cash is still in use for domestic transactions. Paying in cash is the quickest way to process the payment with no fee at all. This is the most significant advantage of cash payment as any other B2B payment method requires fees.

Payment Gateways

UPDATE NOW! Best 10 Magento 2 Payment Gateways in 2020 to utilize online payments!

Payment gateways are B2B online payment methods. B2B payment gateways are built based on digital platforms. With this software’s help, you can process one-time payments on your own, without any reliance on third parties, which makes it the most convenient payment at the moment.

One drawback of B2B payment gateways is the fee incurred. In some cases, such costs might be much higher than traditional digital payment methods.

There are some popular players in terms of this payment method. Let’s take a look at a brief comparison of the top 3 platforms to choose the most suitable one for you.

| No. | Companies | Features/Strengths | Weaknesses | Price |

| 1 | PayPal |

|

|

|

| 2 | TransferWise |

|

|

|

| 3 | Tipalti |

|

|

|

UNLOCK essential information about PayPal and Magento 2 PayPal and use it for your online website.

Some Concerns about B2B Payments

As we have mentioned, B2B payments play an essential role as if a payment fails, you will lose a considerable amount of money; hence, it will negatively affect your business sales and profit. Also, it makes your image worse in the eyes of customers.

For that reason, traditional B2B payment methods have a lot of concerns both for sellers and buyers.

Time-consuming Issue

On average, it takes more than 30 days for a B2B payment to be completely processed. This means that sellers have to wait for more than 1 month to receive their money, which is quite time-consuming.

This is due to the complication of the B2B payment process and the considerable number of transactions made daily.

High Cost

Cost is another concern for B2B businesses. Transaction and maintenance costs are quite expensive for businesses. For example, if your enterprise uses B2B card payment or B2B wire transfer payment, you need to pay an extensive fee to the bank.

This type of cost is quite affordable for medium to large enterprises; however, it is not for small businesses.

Unsuitable Payment Method

Each B2B business might have suitable payment methods. But whether such an approach is also acceptable for their buyers is a big question. This might create a controversy between you and your buyers, and you have to timely solve this problem to satisfy your customers.

Insecure Payment

Security is considered the most crucial aspect that needs to be guaranteed when making payment, especially large-amount payment as B2B payment. In a world that everything can be done with one click, security can be compromised anytime.

If that is the case, your business will lose reliability and your customers undoubtedly. And even worse, you have to compensate your buyers, even if it’s not your fault.

Ambiguity

It is always a sensitive problem when referring to money. Accordingly, transparency is always the customers’ concern. To avoid ambiguity, updating transactions’ status in real-time and showing it to customers is necessary to improve your reliability.

However, with traditional B2B payment options, it’s quite challenging to update such information at any given time. For that reason, a digital base is highly recommended.

Read more:

How To Set Up Magento 2 Payment Methods? (Part 1)

How To Set Up Payment Methods In Magento 2 (Part 2)

Best Practices in B2B Payment for Sellers & Buyers

Here below are some best practices in B2B payment that are useful for both sellers and buyers.

Best Practices for Sellers

- Invoice customers right after processing payments: You should not wait until the end of the month to send customers invoices. In this way, you can fasten the payment process as soon as possible

- Encourage customers to make digital payments: Although check or cash is still commonly used, it is risky for many reasons we have said above. With the convenience of digital methods, you should drive customers to move to such payment methods.

- Encourage customers to make payments early, on time: The feeling of waiting for payments is quite annoying. And it is even worse when customers make payments overdue. Therefore, considering early payment discounts and late payment penalties is necessary.

- Cooperate with a B2B credit and payment partner: In case you offer net payment terms to your buyers, which means that you advance funds to your buyers and you accept the risk of non-payment or overdue payment. To eliminate such a risk, cooperation is highly suggested.

Best Practices for Buyers

- Make B2B electronic payment instead of checks: It takes time to send checks in person or through the mail. Therefore, making B2B electronic payment will save you time. Moreover, it makes it easier for accountants to record cash outflows and inflows.

- Notify the seller if you cannot pay on time: No businesses want late payments to cause cash flow issues. Correspondingly, if you feel that you cannot make payments on time, you should let the seller know beforehand. Who knows that the seller will be flexible on this problem.

- Negotiate with the seller for better payment terms: When making payment terms in the contract, the seller will inform you. If you think that you need a longer time to make payments or prefer other payment methods, you should negotiate with them. They will be willing to consider as they need to create a stable relationship with you.

Final Thoughts

Above is all you need to know about B2B payment, specifically, B2B payment methods with their pros and cons. As payment is essential for a business, you should take those options into careful consideration. We hope that this blog is helpful enough for you that you can choose the right method for your business.

If you have any issues with the B2B e-commerce business, don’t hesitate to share with us.

BSS Commerce is one of the leading multi-platform e-commerce solution providers and web development services in the world. With experienced and certified developers, we commit to bringing high-quality products and services to effectively optimize your business.

CONTACT NOW to let us know your problems. We are willing to support you every time.