New regulations in the EU tax law have had a lot of impact on e-commerce stores. Therefore, to keep up with the contemporary context, you will need knowledge about how to set up Shopify Tax-Exempt for B2B/wholesale customers in the EU.

The article will tell you more about Shopify tax settings/ Shopify sales tax and why you should apply tax exemption for EU wholesale customers. Not only that, the report will tell you two ways to Tax Exempt for B2B/ wholesale customers.

By executing a few simple activities from the settings in your Shopify admin, you may make a customer totally tax-free. Here are step-by-step instructions for setting up Shopify Tax Exempt customers.

Let’s get started now!

Contents

- 1 What Is Shopify Tax-Exempt?

- 2 Why Should Set Up a Shopify Tax-Exempt In The EU?

- 3 How To Set Up Shopify Tax-Exempt For B2B/Wholesale Customers In The EU

- 4 Features of Shopify Tax Exempt

- 5 Tips For Wholesale Stores Have B2C Customers And Two B2B Customers Types

- 6 Conclusion

What Is Shopify Tax-Exempt?

An exempt supply is one in which no VAT is imposed, whether at the ultimate level of sale to the consumer or at some intermediate business-to-business stage. Sellers must charge sales tax on all Tax Exempt transactions unless the jurisdiction rules allow for the deal to be made tax-free. When making a tax-free purchase, an exempt organization or individual must provide an exemption certificate to the seller.

If your company is based in the EU, you will have varied VAT requirements depending on who you buy from or sell to and whether you are trading in products or services

Moreover, exemptions are granted based on the customer’s purchase and always necessitate verification. Under a state’s statutes, different purchasers may be given exemptions. Exempt organizations are classified into several sorts.

As a result, If your Shopify store is based in the EU and your company is VAT-registered, you should not charge VAT to business customers from countries other than your own.

This means that business clients should be designated as Tax Exempt so that they are not charged tax at the time of purchase.

For example, if you sell a product to an EU-VAT registered business in another EU country, you do not have to charge VAT on that sale. If you sell the identical goods to a final consumer within the EU, you may be required to charge VAT at the rate applicable in their country.

That’s also why you need to learn how to set up Shopify Tax-Exempt for B2B/wholesale customers in the EU, which we will go into more detail in the section below.

Why Should Set Up a Shopify Tax-Exempt In The EU?

When selling to customers from other EU nations, you must differentiate between selling to consumers and selling to businesses. Why?

First, the 2021 EU e-commerce VAT package, which is set to effect on July 1, 2021, will significantly impact e-commerce enterprises with EU clients. For VAT reasons, the sale between the seller and the buyer is viewed as two independent transactions:

- The commodities are sold to the marketplace by the seller. This is now a Tax Exempt business-to-business (B2B) transaction, and no EU VAT is owed.

- The goods are sold to the customer by the marketplace. This is now a business-to-consumer (B2C) transaction, with the market collecting the VAT payable based on the customer’s country of residence.

To make it valid and consistent with accounting legislation, you may incorporate VAT numbers from business customers on your invoices. You can also include a notation saying that services are subject to the reverse charge, and the recipient must account for that VAT following Article 196 of Council Directive 2006/112/EC.

| Customers | B2C | B2B |

| The same EU country | VAT | VAT |

| Other EU country | VAT | No VAT |

| Outside the EU | No VAT | No VAT |

That means you do not charge VAT for either physical or digital items when selling to enterprises having valid VAT registration numbers from other EU nations.

In your Shopify store, such clients should be recognized as Tax Exempt. Furthermore, before allowing your business customers to purchase your products, you should capture and check their VAT registration numbers.

What’s more, automatically setting up a Shopify Tax-Exempt in the EU will save your customers from having to ask you every time they make a purchase, which saves both you and your customers time and effort. That means your Shopify store provides a quick and easy for customers in the buying process that enhances the shopping experience. From here, you will also easily create loyal customers from Shopify sales tax.

Read More: How To Set Up B2B And Wholesale Stores On Shopify In A Effective Way if you are interested in generating many loyal wholesale customers and have a steady monthly income.

However, because product prices on Shopify always contain VAT, the only option to avoid the tax for EU merchants is to manually designate consumers not to collect their taxes in Shopify Customers. Therefore, that is why the advent of third-party applications – B2B/Wholesale Solution. Specifically, the Shopify Tax-Exempt feature from B2B/Wholesale Solution app allows your company to sell to EU consumers who have validated EU VAT numbers at tax-free pricing.

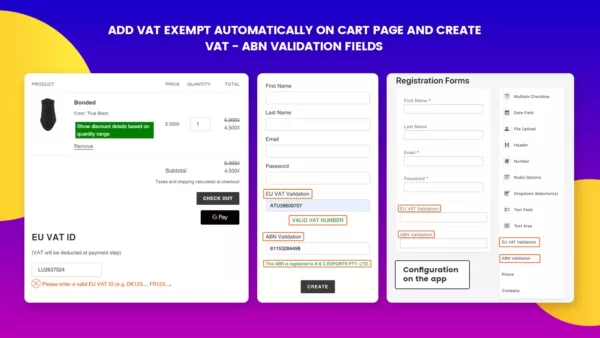

B2B/Wholesale Solution helps you add VAT exempt automatically on the cart page and create VAT – ABN validation fields.

In addition to automatically deducting the VAT from the purchase price if the customer enters their validated EU VAT number, the app also offers a VAT ID added on the Orders as an attribute. It will add the customer’s EU VAT number to their orders so you can record them easily. Even better, it will also be saved in their order records to shorten future purchases.

Last but not least, with all those great features but one-click functionality setting. You can also contact customer support for thorough instructions for manual installation if the feature doesn’t work with your theme.

How To Set Up Shopify Tax-Exempt For B2B/Wholesale Customers In The EU

As mentioned above, there are two ways to set up Shopify Tax-Exempt. One is to do it manually on Shopify’s customer pages, and the other is to take advantage of the convenience of a third-party application. We’ll walk you through both, and consider which one is better for you.

Way 1: Set Up In Shopify Admin

NOTE: If the tax is already included in the product pricing, the tax will not be deducted from the published price for a customer who is configured to be tax-free. Therefore they will have to pay the entire shown amount.

Therefore, this is not a thorough approach and is only suitable for small and beginner stores. However, it is still inconvenient to manually Tax Exempt for b2b/wholesale customers and save them in customer records.

Step 1: Go to Customers

Go to the Customers area on the left after logging in to your Shopify account. Below is what you will see after logging into Shopify.

Go to the Customers section to adjust Shopify sales tax

Step 2: Click the name of the customer

After clicking on the Customers part, your customer list is on show. To be excluded from all sales taxes, click the customer’s name.

Step 3: Click Manage in the Tax Settings section

A “Tax Settings” section is located to the right of the Customer profile page-select Manage.

This is the manual way I want to talk about. Imagine if you had hundreds of customers; what would it be like? Moreover, this means you will have to manually check the validation of each guest if you want an EU Shopify Tax-Exempt.

Step 4: Uncheck the “Collect tax” box

Uncheck the “Collect tax” box at the bottom of the page in Edit tax exemption.

Step 5: Click Save

Click Save in the last step and your consumer will no longer be taxed.

Thus, the most significant advantage of this approach is that it is entirely free. Besides, you can see that the five steps above are straightforward, but that is when you only have a few customers, and your store size is small. This approach is almost impossible in the case of larger stores and more customers, especially on big holidays.

Therefore, the second way will help you eliminate all disadvantages and save most of your time and effort. Let’s learn how to set up Shopify Tax-Exempt for b2b/wholesale customers in the EU more effectively!

Way 2: Leverage the 3rd-Party App

If you own a Shopify store in the European Union, you must understand when to charge VAT and which tax rate applies to which consumer. Besides, as mentioned above, taking advantage of third-party applications is the fastest and most convenient at the moment. The application does very well with the primary task (EU Tax Exempt) is B2B/Wholesale Solution – an All-in-one wholesale solution for merchants from BSS Shopify Commerce.

Step 1: Enable the VAT EXEMPT module in the Dashboard.

After downloading the app in the dashboard location, in the dashboard, activate the Shopify Tax-Exempt feature. As you can see in the image, a strong point of the application is being able to choose as many features as you want to use instead of having to use them all. Therefore, you can thoroughly choose the features you want with this complete wholesale solution.

Later, the customer’s shopping cart will automatically display an “EU VAT ID” box so that the customers can enter their EU VAT number. The VAT Validation box on the cart page will look like this.

Please go to the Manual Installation Guide under the Installation tab if you cannot see the box.

There are codes available here that you can copy to the store’s cart page even if you don’t have coding knowledge.

Step 2: In the Settings, press Enable for “Select EU VAT for specific countries.” Untick the countries you want to collect VAT. Tick the countries you wish to VAT-Exempt.

As shown in the image above is an example of Shopify Tax-Exempt in different countries:

- VAT will be collected from Germany (DE) and Denmark (DK) customers.

- VAT will be waived for customers from other EU nations

Customers will be charged VAT if they provide their EU VAT number from Germany.

An example of a customer submitting a VAT ID from Germany will not have a Tax Exempt.

In contrast, Customers who submit the EU VAT Number of Austria will be EU Tax Exempt.

An example of a customer submitting a VAT ID from Australia will have Tax Exempt.

Furthermore, the app gives you more benefits than that. Specific to mention is the ability to show price incl/excl tax on the product page.

You can freely include/exclude tax displayed on the product page/cart page. Also, whether the “All Prices Include Tax” option is selected or not, it works nicely.

If you need to display pricing with/without tax to particular consumers on a product page, the Tax Display function can assist you. With just a few simple steps like the instructions on How to show price incl/excl tax on the product page, you can already include or exclude Shopify tax displays. You should use this feature on a case-by-case basis.

Additionally, the feature is available in our Advanced Plan ($50/month), and you will have 14 days to try it out for free.

DOWNLOAD APP NOW:

If you want to attract as many clients as possible to your marketplace, you should offer their product prices without Shopify tax (VAT). This is because you do not charge tax when you sell outside of your taxable territory. There are exceptions, but this is how it is in most countries.

For example, if you sell a product for 100 euros in France, your product price will be presented as 100 euros, and VAT at 19.6 percent will be added to the price at the time of purchase. The total bill amount will then be €119.60.

In contrast, if you want to include tax in your pricing, you should not include tax in your shop management and show your products with tax included in the price. The invoice will not add tax in this manner.

However, keep in mind that listing your price as “all taxes” (VAT) can limit your capacity to sell outside of your country because shoppers will notice that your price is higher for no reason.

Features of Shopify Tax Exempt

Setting up tax exemption in your Shopify store is easier when you use the right tools. While there are various tools available, this guide will focus on using the Shopify Tax Exemption App to configure tax exemptions efficiently. With this app, you can tailor functionality to suit your business needs.

Manage Tax Exempt Settings

Shopify Tax Exempt Extension allows you to enable the application and set an admin email address through which the administrator is notified of customer tax exemption requests. Not only does it make the store management work easier, but it also guarantees customer satisfaction, building trust in your brand.

Display Tax Exempt Status

Shopify Tax Exempt Extension allows you to create a tax exemption status and display it for customers right in your store. That is, this option gives you more flexibility, which can enable customers not to pay their taxes under certain conditions.

Here is the list of tax exemption statuses you are able to choose from:

- Approved

- Pending for Approval

- Disapproved

- Expired

Notify Customers and Admins About Tax Exemption

Shopify Tax Exempt Extension allows notifications for both customers and admins. With this option, you will be able to:

Notify Customers:

Show notifications on the cart page regarding customer exemption status. By making one word-for example, “Click here”- a link, you are able to easily forward customers to any page you want. This is a very user-friendly way of keeping your customers informed.

Notify Admins:

Show admin notifications on an order page when the customer qualifies for a tax exemption. That’s for you to keep clear about messages, smoothly redirect clients through sites, and take into account every admin request in no time.

Using this notification ability will help bring clarity, keep clients happy, make their and the admin’s navigation really easy, and smooth.

Custom Text Fields and Text Areas

Shopify Tax Exempt Extension enables you to enable and edit the form of tax exemption with the following types:

- Text field

- Text Area

- Input Field

You can even allow file uploads in the format of PDF, JPG, PNG, and DOCX among others. You can get detailed information about customers using this custom field. Also, by enabling text area, a customer can add extra information where it is needed.

Using this module, you can:

- Configure field labels as per your requirements

- Mark a field as “Required”

- Customize your form to meet your store’s goals and brand requirements.

Configure Customer-Based VAT Exemption

Set up Value-Added Tax exemptions for customers using this Shopify Tax Exempt Extension. To set up VAT exemption, follow the following steps:

- Enable VAT exemption if the customer is eligible.

- In the field label and placeholder, add the VAT number.

- Edit the verification button text and color and the background color.

- Add your custom alerts for valid or invalid VAT numbers.

- Set the alignment for the validation messages by selecting left, right, or center.

- This helps comply with tax obligations and, at the same time, makes life easier for VAT-exempt customers.

Customer Tax Exemption Criteria

Shopify Tax Exempt Extension enables you to set up tax exemption criteria customers for certain tags:

Auto-Approval:

Choose customer tags for which a request will not be required, yet they’ll get approved automatically for a tax exemption.

Manual Approval:

Set customer tags for those customers who can apply for a tax exemption or whose request needs approval upon submission.

This feature gives you the flexibility to manage tax exemptions more efficiently while catering to customer-specific needs.

Simplify Customer and Admin Notifications

Shopify Tax Exempt Extension allows you to create and send custom email notifications to customers and admins. You can:

- Notify customers about their status of tax exemption, such as approved, disapproved, pending, or expired.

- Customize the notification message to fit your store’s tone and voice.

- Ensure that the admin gets emailed about valid requests when the status is “pending”.

Tips For Wholesale Stores Have B2C Customers And Two B2B Customers Types

We will provide you with another tip about how to set up Shopify Tax-Exempt for B2B/wholesale customers in the EU.

Traders from Germany, for example, and traders from other EU countries:

- Include tax with customers that buy from you regularly (B2C)

- Include VAT with German traders

- VAT does not apply to traders from other EU nations.

We strongly advise utilizing the following modules in this situation:

- Custom pricing feature (set up custom prices for B2B Customers)

- Using the form for Wholesaler Registration (create a custom registration form for B2B Customers)

- VAT Exempt and Tax Inc/Exc (compute tax incl/excl for B2B/B2C customers on the checkout page)

In this case, once again B2B/Wholesale Solution app can help you manage your wholesale store well with all the necessary features about Shopify sales tax.

Read More: Setting up Tax Exempt/collect tax for B2C customers and two types of B2B customers

Conclusion

How to set up Shopify Tax-Exempt for b2b/wholesale customers in the EU? I hope that after this article you can quickly answer this question. With the instructions on the two ways above, you can ultimately choose the more suitable way for your store. However, keep in mind that if your store serves both general and wholesale customers, it is essential to use a third-party app. Instead of wasting time on manual setup, you can completely take care of your sales strategies.

If you think that you can save money by doing it manually, you are entirely wrong. As your wholesale business grows, you will need more labor to deal with Shopify Tax Exempt than if you want to do it manually. Therefore, you will still have to pay an equivalent or even more significant amount for using the application.

Finally, I hope this article will help you smoothly work with your EU wholesale customers!